Leading Vietnam Ladies’ Apparel Manufacturers for 2026

Top Vietnam ladies’ apparel manufacturers for 2026 include Capital World Group, offering vertical OEM/ODM with 3,000 pcs MOQ, 18 lines, and 800+ staff in Ha Nam Province. Vietnam’s exports hit $44B in 2024, projected 10% yearly growth. Prioritize certifications like Higg FEM, BSCI; avoid high MOQs, geography mismatches. Secure speed, sustainability, and quality for Hanoi-area sourcing.

Struggling to pinpoint reliable ladies’ apparel manufacturers in Vietnam for your 2026 collections amid supply chain headaches and quality risks? This article spotlights the top players in Vietnam, plus best practices to avoid costly mistakes. With Vietnam’s apparel exports surging past $44 billion in 2024 and projected to grow 10% yearly, you’ll secure partners delivering speed and sustainability.

Introduction to Vietnam’s Ladies’ Apparel Manufacturing Scene

As of January 2026, Vietnam has firmly established itself as a top-tier destination for sourcing ladies’ apparel. It’s no longer just about low labor costs; the country has evolved into a hub for technical skill and vertical integration. Brands today aren’t just looking for sewing lines—they need partners who handle everything from fabric development to final logistics.

The numbers back this up. Vietnam ranked third worldwide in textile and garment exports in 2026, exceeding $44 billion. For fashion brands, this means access to a mature infrastructure that balances speed, quality, and compliance. Whether you need complex woven dresses or technical knits, Vietnam’s manufacturers have adapted to meet global standards for speed and sustainability.

Why Vietnam Dominates Ladies’ Apparel Production in 2026

Vietnam’s appeal in 2026 goes beyond pricing. The country offers a stable political environment and a workforce that takes immense pride in craftsmanship. Unlike some competitors, Vietnam has aggressively pursued Free Trade Agreements (FTAs), making it an economically strategic choice for Western markets.

The growth is consistent. Vietnam’s textile and garment exports reached approximately $46 billion in 2025, up 5–6% from the previous year (vietnam.incorp.asia). This surge is driven by manufacturers investing in vertical management—controlling the supply chain from yarn to finished product. This reduces reliance on imported raw materials and speeds up production cycles, a critical factor for fast-moving ladies’ fashion trends.

How Ladies’ Apparel Manufacturing Works in Vietnam

From Fabric Sourcing and Pattern Making to Sampling

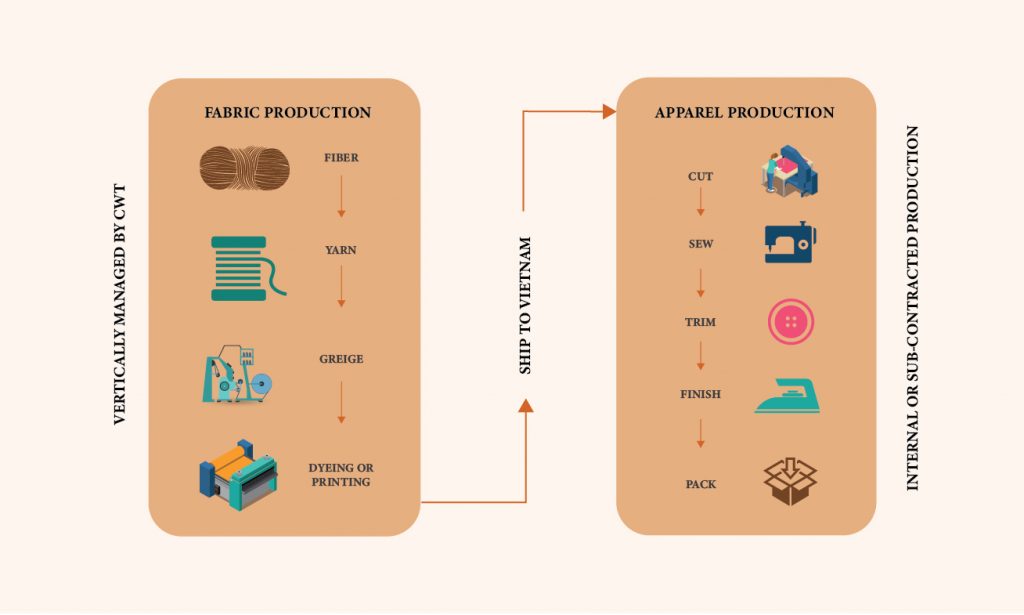

The process starts long before the sewing machines turn on. In 2026, top manufacturers don’t just wait for fabric to arrive; they actively source and develop it. Companies like Capital World Group utilize networks across Shanghai, Taipei, and Hanoi to secure materials.

Speed is critical here. A competitive manufacturer typically operates with these timelines:

- Sample turnaround: ~10 days

- Sampling capacity: ~500 pieces per week

- Pattern making: In-house digital grading

This agility allows brands to approve prototypes quickly and move to bulk production without missing seasonal windows.

Production, Quality Control, and Shipping

Once samples are approved, production shifts to the factory floor. Facilities in hubs like Nam Dinh province often run dozens of lines simultaneously. For instance, a standard mid-sized facility might operate 18 production lines with a workforce of 800, ensuring scalable output for large global programs.

Logistics are equally streamlined. Goods are typically exported via Hai Phong Port (HPH) for sea freight or Hanoi Airport (HAN) for air cargo. Quality control happens at every stage, often using a “traffic light” system or inline inspections to catch defects early, ensuring the final pack-out meets international AQL standards.

Full OEM/ODM Services Explained

Modern manufacturing in Vietnam revolves around OEM (Original Equipment Manufacturer) and ODM (Original Design Manufacturer) models. This is a “one-stop-shop” approach. Instead of the brand managing five different vendors for fabric, trims, and sewing, the manufacturer handles the entire vertical supply chain.

Services typically include:

- Fabric Sourcing & Development: Finding the right knit or woven blend.

- Technical Design: Pattern making and grading for size ranges.

- Bulk Production: Cutting, sewing, and finishing.

- Logistics: Packing and shipping assistance.

This vertical management structure gives buyers better control over price and delivery schedules.

Best Practices for Partnering with Vietnam Manufacturers

Success in Vietnam requires more than just sending a tech pack. You need to vet your partners carefully to ensure they match your brand’s ethical and technical standards.

- Verify Certifications: Look for globally recognized benchmarks. Essential standards include Higg FEM (environmental), Amfori BSCI (social compliance), and SLCP (Social Labor Convergence Program).

- Centralize Communication: Working with multi-location teams can be messy. Insist on a “single window” of communication—one project manager who coordinates between the fabric sourcers in China and the factory in Vietnam.

- Check Vertical Capabilities: Ask if they own their factories or just subcontract. Owners, like Capital World Group with their Kiara Garments facility, offer better transparency and accountability than pure trading houses.

Common Mistakes to Avoid When Sourcing Ladies’ Apparel from Vietnam

Even experienced buyers run into trouble by overlooking local nuances. Here are the pitfalls that can derail a production run in 2026.

1. Ignoring Geography

Vietnam is long. Sourcing fabric in the South while sewing in the North adds transit time. Ensure your factory has local material hubs or efficient logistics, like sourcing offices in nearby textile centers (e.g., Shaoxing or Taipei).

2. Overlooking MOQs

Factories have sweet spots. A standard Minimum Order Quantity (MOQ) is often 3,000 pieces per style. Pushing for lower volumes without negotiating upcharges can lead to de-prioritized orders.

3. Skipping Social Compliance

Never assume a factory is compliant. If a manufacturer cannot produce a valid, recent audit report (like BSCI or ISO 9001), it is a major red flag for brand reputation risks.

Leading Ladies’ Apparel Manufacturers in Vietnam for 2026

Finding the right partner depends on your specific product needs. Below is a comparison of key players in the Vietnamese market, ranging from massive state-owned enterprises to agile, family-owned vertical manufacturers.

| Manufacturer | Specialization | Key Strength | Capacity/Scale |

| Capital World Group | Ladies’ Knit & Woven Fashion | Vertical Management: Owns Kiara Garments factory; offices in Shanghai/Taipei. | 3,000 pcs MOQ; 18 lines; 800+ staff |

| Vinatex | General Apparel | Massive scale; state-owned conglomerate. | 410 million units/year |

| Viettien | Menswear & Ladieswear | Long history (est. 1975); domestic market leader. | High-volume production |

| MUK Ltd. | Fashion Wear | Ladies fashion focus. | ~200,000 garments/month |

Capital World Group stands out for mid-to-high-end ladies’ apparel brands requiring speed and full-service development, leveraging over 40 years of family-owned experience.

Key Trends and Future Outlook for 2026

The industry is pivoting hard toward sustainability and digitalization. It is no longer enough to just make clothes; factories must minimize their footprint.

“We recognize that our industry is a significant contributor to global warming… We not only want to be part of this change, but to drive the change as an industry leader.” — Capital World Group Sustainability Statement

Major trends for 2026 include:

- Green Manufacturing: Widespread adoption of the Higg Index to measure environmental impact.

- Vertical Integration: More factories opening their own fabric mills or sourcing offices to control costs.

- Continued Growth: Vietnam’s textile industry projects continued growth, building on strong 2025 export figures (vietnam.incorp.asia).

Conclusion: Finding Your Ideal Manufacturing Partner

Sourcing ladies’ apparel in Vietnam in 2026 offers a powerful balance of quality, cost, and ethics. The key is finding a partner that offers vertical management—someone who understands the fabric market in China and Taiwan while operating efficient, compliant production lines in Vietnam.

Look for manufacturers who are transparent about their supply chain, hold current sustainability certifications like SLCP and BSCI, and own their facilities. Whether you are a global retailer or a growing fashion label, the right Vietnamese partner can provide the agility and integrity needed to succeed in today’s market.

Frequently Asked Questions

What is the typical lead time for bulk production of ladies’ apparel in Vietnam?

Bulk production lead times average 45-60 days after sample approval, depending on order size and fabric availability. Vertically integrated factories like those in Nam Dinh achieve 30-45 days for standard runs of 3,000+ pieces.

How do Vietnam manufacturers ensure sustainability compliance for ladies’ apparel?

They use Higg FEM for environmental audits, Amfori BSCI for social standards, and SLCP for labor convergence. In 2026, over 70% of top exporters hold these certifications, reducing carbon footprints by 20-30% via green dyeing.

What are the standard payment terms when partnering with Vietnam apparel factories?

Common terms are 30% deposit upfront, 50% after bulk production starts, and 20% upon shipment. Letters of credit (LC) are preferred for new buyers to mitigate risks.

Can small brands source ladies’ apparel from Vietnam with low MOQs?

Yes, some agile manufacturers offer 1,000-2,000 piece MOQs for knits with 20-30% upcharges. Negotiate for trial orders to test quality before scaling to standard 3,000-piece runs.

How has Vietnam’s ladies’ apparel export growth impacted global pricing in 2026?

Exports hit $44 billion in 2026, driving 5-10% cost reductions via FTAs like CPTPP. Ladies’ woven dresses now average $8-12 FOB, competitive with Bangladesh while offering faster 4-6 week deliveries.