As cost pressures intensify across the global apparel market, the sourcing strategy has become a decisive factor in protecting margins. For fashion brands manufacturing in Vietnam, the choice between nominated sourcing and local sourcing directly influences material pricing, production agility, and supply-chain stability. Each approach offers distinct benefits and trade-offs depending on a brand’s business model and risk tolerance.

This guideline will explore the key differences between nominated and local sourcing, examine their impact on costs, lead times, and supply-chain control, and help brands identify the sourcing strategy that best supports margin performance and long-term growth.

Quick comparison of nominated vs. local sourcing

Sourcing decisions shape your cost base, flexibility, and risk exposure. Choosing between nominated and local sourcing impacts not only material pricing, but also lead times, inventory management, and supplier accountability.

| Criteria | Nominated Sourcing | Local Sourcing |

| Fabric & trim supplier | Brand-nominated | Manufacturer-managed |

| Cost control | Limited negotiation flexibility | Optimized through bulk and local networks |

| Lead time | Often longer due to coordination | Shorter with integrated sourcing |

| Risk management | Shared across multiple parties | Centralized under one partner |

| Best for | Brands with strict material mandates | Brands prioritizing margin and speed |

What is nominated sourcing?

Nominated sourcing is a procurement model where the fashion brand selects and mandates specific fabric or trim suppliers. The garment manufacturer executes production using these approved materials, ensuring brand-level consistency, compliance, and quality control across multiple factories or sourcing regions.

Key advantages of nominated sourcing

- Material consistency across suppliers: Brands maintain identical fabric specifications across multiple factories and countries, reducing variation risks.

- Stronger compliance control: Easier alignment with sustainability, chemical, and traceability standards required by global retailers.

- Centralized cost visibility: Buyers negotiate fabric pricing directly, improving transparency across sourcing regions.

- Quality assurance at scale: Approved suppliers follow established testing and performance benchmarks.

- Brand protection: Reduces reputational risk linked to unauthorized or non-compliant materials.

Limitations of nominated sourcing

- Higher total landed costs: While the brand may negotiate fabric prices, international freight, import duties, and higher MOQs often increase overall material costs.

- Longer production lead times: Overseas fabric sourcing can delay sampling approvals and bulk production start dates.

- Reduced manufacturing flexibility: Factories have limited ability to adjust sourcing to improve speed, cost efficiency, or problem resolution.

- Greater coordination complexity: Successful execution depends on close alignment between the brand, nominated suppliers, and the manufacturing partner.

Considerations before choosing nominated sourcing

Before adopting nominated sourcing, brands should evaluate their need for strict material consistency, compliance requirements, and centralized supplier control. It is essential to assess total landed costs, potential lead-time impacts, and supply-chain resilience, while ensuring manufacturing partners have proven experience managing nominated suppliers and coordinating complex, multi-party sourcing workflows.

What is local sourcing?

Local sourcing is a supply chain model in which a garment manufacturer sources fabrics and trims from approved suppliers located within the same country or a nearby region. This approach emphasizes shorter lead times, greater production flexibility, and lower logistics costs to support faster, more responsive apparel manufacturing.

Primary benefits of local sourcing

- Accelerated speed to market: Sourcing fabrics and trims close to the manufacturing site significantly shortens development and production lead times, enabling faster product launches than nominated sourcing models.

- Lower total landed costs: Reduced international freight, import duties, and inventory holding requirements help brands better control overall sourcing expenses.

- Greater production agility: Local availability allows quick adjustments to styles, colors, or order volumes in response to real-time sales performance.

- Lower risk through smaller MOQs: Ideal for testing new designs, managing demand uncertainty, and replenishing bestsellers.

- Stronger operational collaboration: Proximity between the factory and suppliers improves communication, quality oversight, and problem resolution throughout production.

Challenges of local sourcing

- Limited material innovation: Local suppliers may lack access to advanced performance, technical, or specialty fabrics, making it harder to support premium or highly differentiated products.

- Capacity and scalability constraints: Large or long-term production programs may exceed the output capabilities of local mills.

- Compliance readiness gaps: Not all local suppliers meet international standards for sustainability, chemical management, or social responsibility.

- Supplier concentration risk: Heavy reliance on a small number of local suppliers increases vulnerability to disruptions, quality issues, or capacity shortfalls.

Considerations before choosing local sourcing

Before selecting local sourcing, brands should assess their speed-to-market priorities, volume stability, and material complexity. It is important to evaluate the manufacturer’s quality control systems, supplier audit capabilities, and compliance management. Brands should also consider long-term scalability, supplier diversification, and whether local material options align with performance, sustainability, and brand positioning requirements.

How to choose the right sourcing model

Selecting the right sourcing model depends on your brand’s priorities around cost control, speed, consistency, and supply-chain risk. Both nominated and local sourcing offer distinct advantages, and the optimal approach often varies by product category, volume, and market requirements.

- Define brand priorities: Decide whether material consistency and centralized control or speed and flexibility matter most.

- Assess lead-time tolerance: Longer timelines favor nominated sourcing; fast turnarounds suit local sourcing.

- Evaluate total landed cost: Consider logistics, duties, MOQs, and inventory, not just fabric price.

- Review compliance needs: Premium and regulated markets may require nominated suppliers.

- Leverage factory capability: You can consider choosing partners with strong sourcing governance and vertical integration.

Executing the right sourcing strategy with Capital World Group

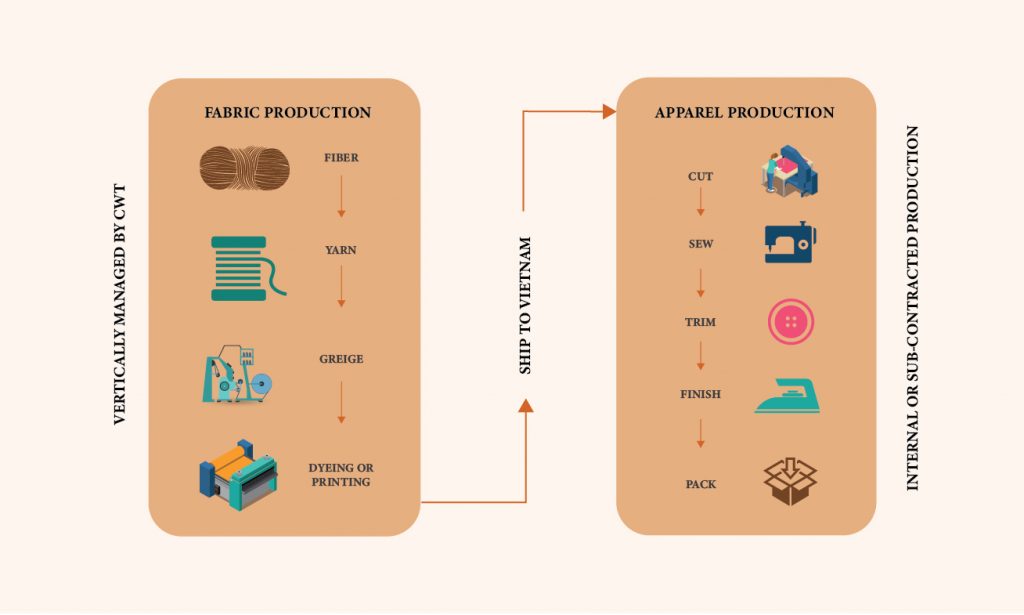

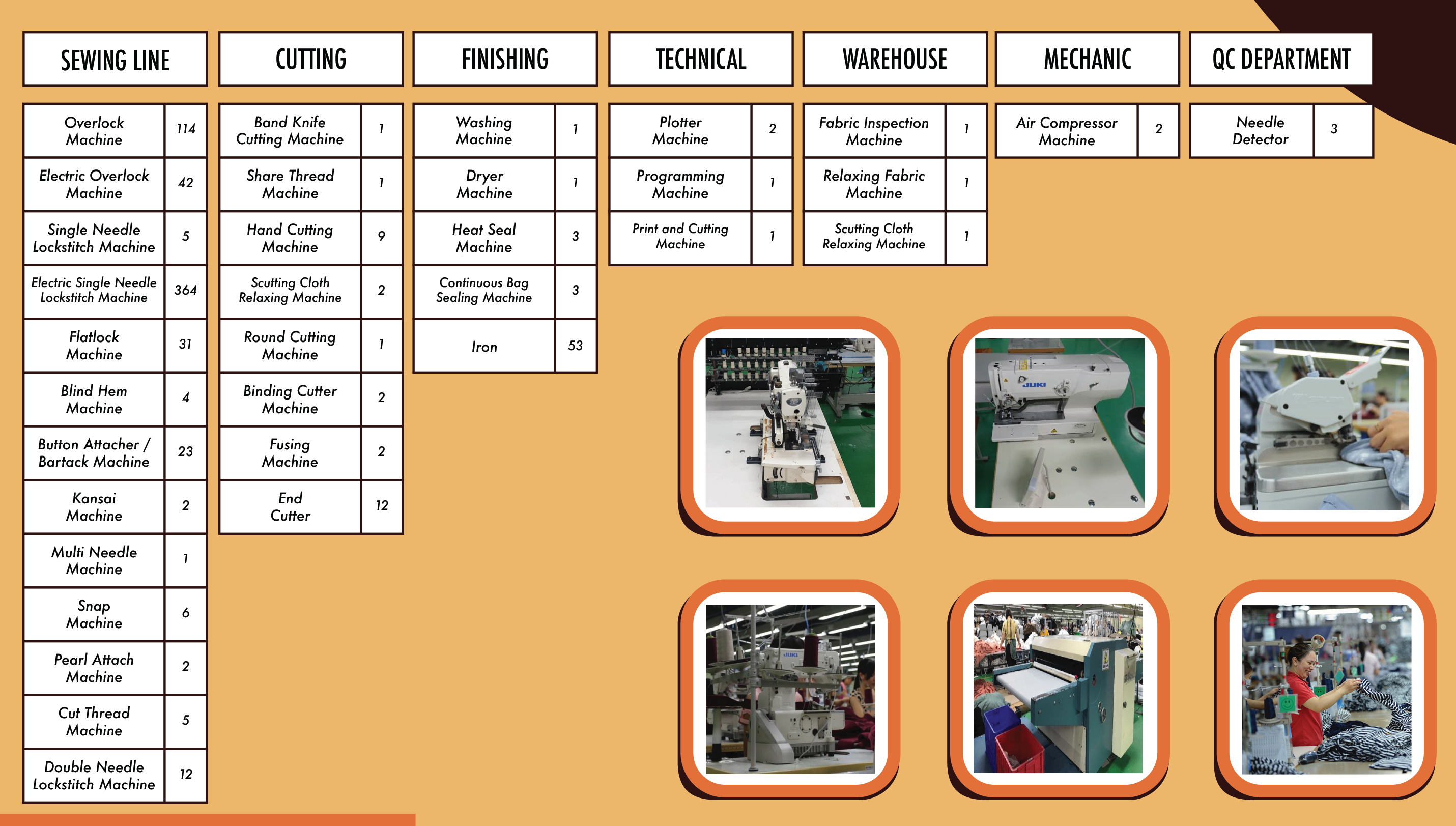

Choosing the right sourcing model is only part of building a resilient apparel supply chain. To execute it successfully, brands need a manufacturing partner with proven experience, deep capability, and reliable delivery. Capital World Group combines vertical integration, quality assurance, and sustainability credentials to help brands optimize cost, adapt to market changes, and consistently deliver high-quality ladieswear on time.

With over 40 years of heritage, comprehensive fabric & trim sourcing, globally recognized quality standards, agile sampling, and scalable production capacity, Capital World Group is a trusted partner for global fashion brands seeking end-to-end control and predictable results. Contact us today to explore how Capital World Group can support your sourcing strategy with integrated manufacturing, reliable execution, and long-term supply-chain stability.