International trade in the fashion industry is complex. Ensuring garment quality, meeting strict customs regulations, and managing global shipping can be challenging, even for established brands. Sourcing apparel from Vietnam, one of the world’s top textile producers, adds layers of documentation and coordination.

However, with the right strategy, Vietnam offers huge opportunities for competitive pricing and skilled manufacturing. This article will guide you through the process of importing clothes from Vietnam into North America.

The Vietnamese garment market

The Vietnamese garment market continues to grow, with apparel export volumes up 9% year-on-year as of May 2025. In the first five months alone, exports reached US$17.58 billion, according to the Vietnam Textile and Apparel Association (VITAS).

The United States is the dominant buyer, taking 38–48% of exports. In Q1 2025, total shipments to the US across all goods surged to US$31.4 billion, up 22% from the prior year. Japan takes about 10% of Vietnam’s textile exports, South Korea 7–10%, and the EU around 9–10%, with solid demand from the Netherlands, UK, and Germany. Vietnam also supplies to more than 130 countries worldwide alongside other clothing manufacturing countries. ASEAN markets account for 6.6%, while Canada, China, the Middle East, and Africa represent 28%.

Source: Vietnam Customs.

With the current sustainable trend in garment manufacturing, many producers now work with eco-materials and hold certifications such as GOTS or OEKO/TEX along with digital adoption in automation and AI technology in up to 40% of facilities. Production is moving beyond cut-make-trim toward ODM (Original Design Manufacturing) and OBM (Original Brand Manufacturing) models that give manufacturers greater design and branding roles.

Reflecting these shifts, Kiara Garments Factory of Capital World Group provides sustainable garment manufacturing for brands with ISO 9001, amfori BSCI, and Higg FEM certifications, ensuring the highest quality and sustainability standards.

Ensuring alignment with Vietnam export regulations

When exporting clothing from Vietnam, the exporter and importer must prepare mandatory documents to satisfy local laws and smooth customs clearance.

Custom declaration form

Each customs declaration form must specify details about the shipment. This includes the consignor and consignee information, the country of origin of the goods, and the Harmonized System (HS code) classification for the apparel.

It also lists the shipping details (mode of transport, port of loading, and destination), a clear description of the goods (e.g., “100% cotton women’s blouses”), the labeling and packaging information, the total value of goods, and the purpose of the shipment (for export as a commercial sale, samples, etc.).

Bill of Lading

The carrier issues this document to confirm receipt of the goods for transport. It records the goods loaded on the ship (or plane/truck) and serves as a contract of carriage. The B/L includes details like the vessel name, departure and destination ports, a list of the shipped items, and the consignee to whom the goods will be delivered.

Commercial contract

The exporter and importer must finalize a commercial contract that sets out legal, financial, and quality details before shipment. This agreement assures product specifications and standards, confirming that all exported goods meet benchmarks such as ISO or third-party quality checks.

- Contract Number, Date, and Parties: States the reference number, signing date, and full legal details of the Seller (exporter) and Buyer (importer).

- Product Commodity Details: It lists the clothing type, material, style, HS codes for customs, and origin (e.g., “Made in Vietnam”).

- Quality: Defines standards via samples, ISO/ASTM criteria, or third-party checks like SGS; may note warranties.

- Quantity: Specifies total goods ordered, unit of measure, and acceptable tolerance (e.g., ±5%).

- Price: Outlines unit price, total value, and currency under an Incoterm (e.g., FOB Haiphong or CIF Los Angeles).

- Shipment Terms: Sets Incoterms 2020 rules, delivery point, mode (sea/air), and final destination.

- Payment Terms: States total payable, method (L/C or transfer), responsibility for charges, and timing tied to the Bill of Lading.

- Packing and Marking: Details packaging, labels, and marks to ensure compliance for export and warehouse use.

- Penalties: Establishes fines for late shipment or defective goods, ensuring contract discipline.

- Insurance: Assigns who covers cargo insurance and specifies coverage under the chosen Incoterm.

- Force Majeure: Lists extraordinary events (war, disasters, bans) excusing performance without liability.

Learn more about FOB term and how it is differentiated from CM (Cut-Make).

Commercial invoice

This is the bill for the goods prepared by the seller. It specifies the amount the buyer must pay for the shipment, the agreed currency and payment method, and typically the seller’s bank account details for the transfer. This invoice is used by customs in the importing country to assess the shipment’s value for duty calculation. It should match the contract and L/C terms. If the shipment is not a typical sale – e.g., samples or gifts – sometimes a pro forma invoice is used instead, but a commercial invoice is standard for normal apparel orders.

Packing list

It details what goods are packed in each box or container, including item descriptions, quantities per carton, carton numbers, dimensions, and weight (net weight of goods and gross weight including packaging).

The packing list mirrors the products and quantities on the invoice but omits any pricing or value information. Its purpose is purely logistical: freight forwarders and customs officers use it to plan storage, arrange handling equipment, and verify the shipment’s contents during inspections.

Export taxes and VAT

Vietnam generally exempts apparel goods from export taxes. This means that most clothing goods are tax-exempt when exported depending on the country, keeping clothes from Vietnam competitively priced for international buyers.

Applying Incoterms in a commercial contract

Incoterms define how shipping, insurance, and customs duties are allocated between parties. In Vietnamese export contracts, the chosen term clarifies who pays for freight, insurance, and duties, and where risk transfers from seller to buyer.

Incoterms 2020 include:

- CIP (Carriage and Insurance Paid To)

- CFR (Cost and Freight)

- CIF (Cost, Insurance, and Freight)

- CPT (Carriage Paid To)

- EXW (Ex Works)

- FCA (Free Carrier)

- DPU (Delivered At Place Unloaded)

- DAP (Delivered At Place)

- FAS (Free Alongside Ship)

- FOB (Free On Board)

- DDP (Delivered Duty Paid)

Choosing logistics strategies

Most brands work with freight forwarders to manage shipping, since these experts can consolidate shipments and handle paperwork to reduce delays. The primary freight options are ocean (sea) and air freight.

Logistics options

Sea Freight – Ideal for companies optimising logistics costs. Ocean transport is the most economical option for bulk orders, though transit to North America can take 3–5 weeks. Two common methods are:

- FCL (Full Container Load): Best for large shipments. It reduces handling and potential damage.

- LCL (Less than Container Load): Shares space with other shippers; cost-effective for small volumes but may face extra handling.

Air Freight – Used for smaller, lighter, or urgent shipments. Air cargo reaches the US or Canada within days, which is valuable for fast fashion or restocking. However, it costs far more per kilogram than sea freight and has size limits.

Delivery strategies

Choosing the right delivery model affects cost, risk, and responsibility once goods leave Vietnam. Providers usually offer three main service levels:

- Port-to-Port: The carrier moves cargo from a Vietnam port (e.g., Haiphong) to a North American port (e.g., Los Angeles). It’s the cheapest option but leaves the importer responsible for customs, duties, and inland transport. Best for those with in-house logistics or a customs broker.

- Port-to-Door: The forwarder handles transport from the Vietnam port through customs clearance and delivers directly to your warehouse. It balances cost and convenience, bundling inland delivery.

- Door-to-Door: The provider collects cartons at the origin factory, manages export clearance, international shipping, customs, and last-mile delivery. It simplifies coordination and saves time, but comes at a premium price.

Regardless of strategy, always secure cargo insurance (marine or air) to protect shipment value against loss or damage.

Import regulations and customs duties of the US and Canada

Compliance with customs regulations is essential to prevent border delays. Both the US and Canada have specific textile requirements, so brands should prepare in advance and work with reputable Vietnamese textile manufacturers. Key considerations include:

- Import quotas and restrictions: Most quotas ended in 2005, but check for embargoes or bans on certain goods (e.g., wildlife-based materials).

- Tariff classification: Use the correct HS code; errors can cause penalties or higher duties.

- Environmental regulation: Meet safety laws on dyes, chemicals, or fumigation for used apparel.

- Intellectual property: Avoid counterfeit logos; customs enforce strict IP rights.

- Product safety and labelling: Ensure origin, fiber content, and care labels meet US and Canadian rules.

- Import permits & licenses: Not usually required, but some items (fur, exotic skins) may need permits.

Staying ahead of these rules ensures smooth clearance and avoids costly delays.

Specific documents and other considerations

Import rules differ between the US and Canada, and apparel shipments must meet country-specific filing requirements to avoid delays at the border.

Importing to the US

U.S.-bound importers must file an Importer Security Filing (ISF) at least 24 hours before vessel departure and submit the ACE Import Manifest Documentation through the Automated Commercial Environment. These records verify shipment details, support customs checks, and help importers clear goods legally.

- Importer Security Filing (ISF): Advance electronic data on shipment details.

- ACE Import Manifest Documentation: Carrier’s electronic manifest for US Customs.

Importing to Canada

Canada’s process mirrors the US import rules but uses its own systems. Canadian customs regulations require full invoice disclosure and declarations. Shipments valued above CAD$2,500 need a Canada Customs Invoice (CCI/CI1) listing vendor, purchaser, origin, currency, and item details.

The importer or broker must also file an Import Declaration electronically (B3 form) to confirm tariff classification, duty, and GST. Conversely, carriers must submit an Advance Commercial Information (ACI) eManifest before arrival (Canada’s version of the US manifest). Accurate paperwork is vital as errors risk penalties or seizure.

First-time importers should obtain a Business Number from the Canada Revenue Agency for clearance. Many apparel goods qualify for reduced or zero tariffs under the CPTPP, provided a valid Declaration of Origin is issued.

Choose the right partner for streamlined sourcing

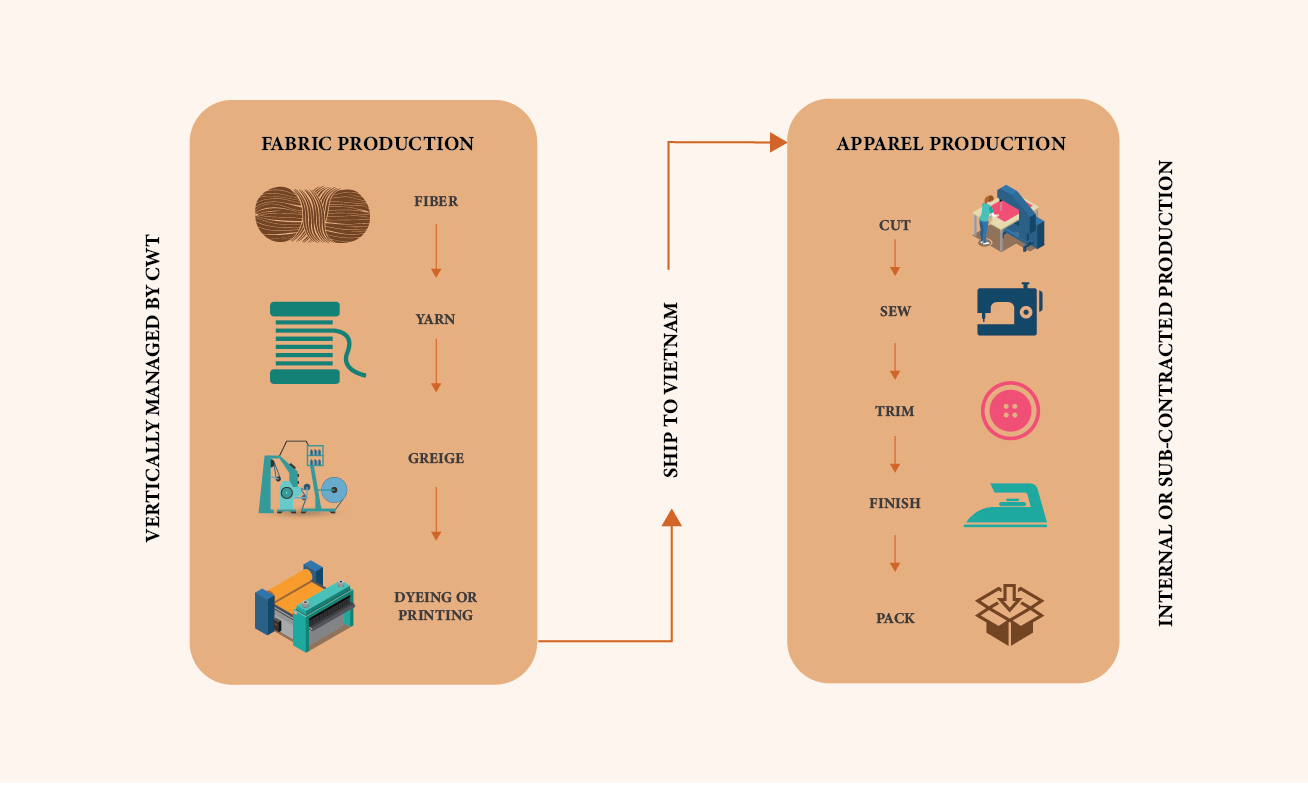

Many brands face rising costs, compliance hurdles, and tight deadlines when sourcing apparel from Vietnam. Capital World Group provides the solution through a vertically integrated supply chain with an end-to-end process of fabric sourcing, production, and logistics. Contact us today to secure dependable Vietnam-based production.